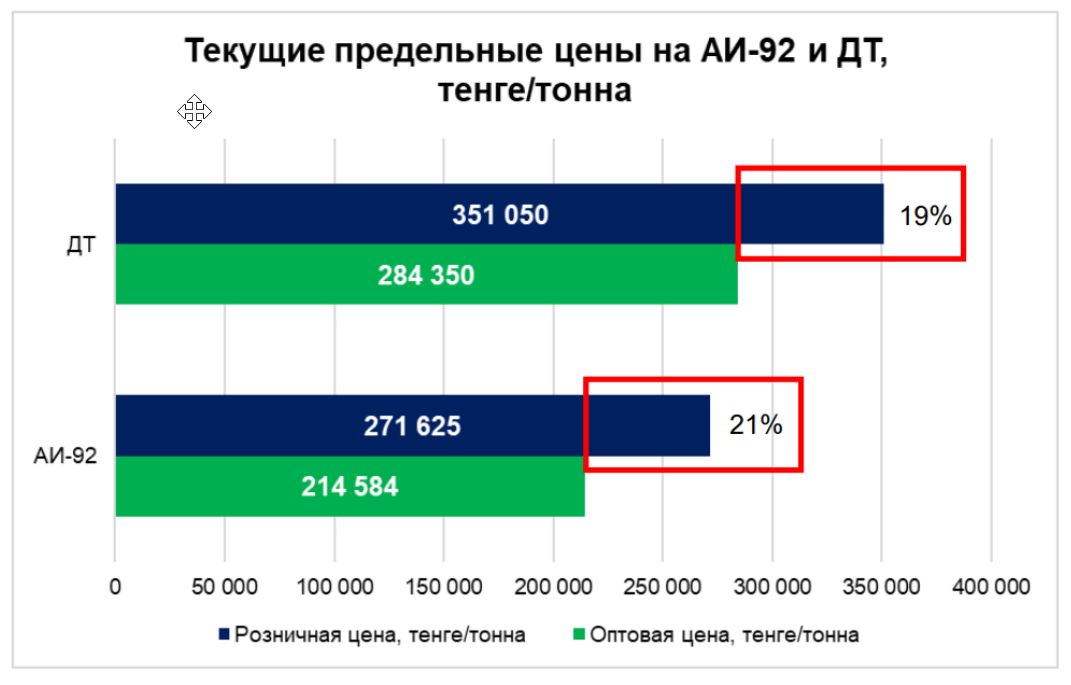

After the approval of maximum retail and wholesale price ceilings for the main types of petroleum products (AI-92, DF), a disparity in profitability has formed between oil suppliers and fueling stations in the Kazakhstan market, and a shift in the money supply from the wholesale market towards the retail market.

These conclusions are based on the results of a large-scale analysis of pricing for the main types of petroleum products (AI-92, AI-95, DF) in the wholesale and retail markets, conducted by the PetroMining Association.

These conclusions are based on the results of a large-scale analysis of pricing for the main types of petroleum products (AI-92, AI-95, DF) in the wholesale and retail markets, conducted by the PetroMining Association.

According to the PetroMining Association, after the adoption of orders of the Minister of Energy of the Republic of Kazakhstan dated April 12, 2023 No. 139 and No. 140, fueling stations became the main beneficiaries, taking into account the annual increase in the cost of processing and transportation. Despite the fact that the main forced measure to increase prices for petroleum products was to prevent fuel shortages due to flows to neighboring countries (transit transport, gray exports). Gas station margins increased: DF from 3 to 10%, AI-92 from 5 to 11%.

“In order to equalize the profitability disparity, it is necessary to reconsider the difference between retail and wholesale prices (Order of the Minister of Energy of the Republic of Kazakhstan dated 08.12.2014 No. 184 as amended by the Order of the Minister of Energy of the Republic of Kazakhstan dated 12.04.2023 No. 138) for diesel fuel from 19% to 15-14 %, for AI-92 from 21 to 15%,” suggested the PetroMining OPOs Association.

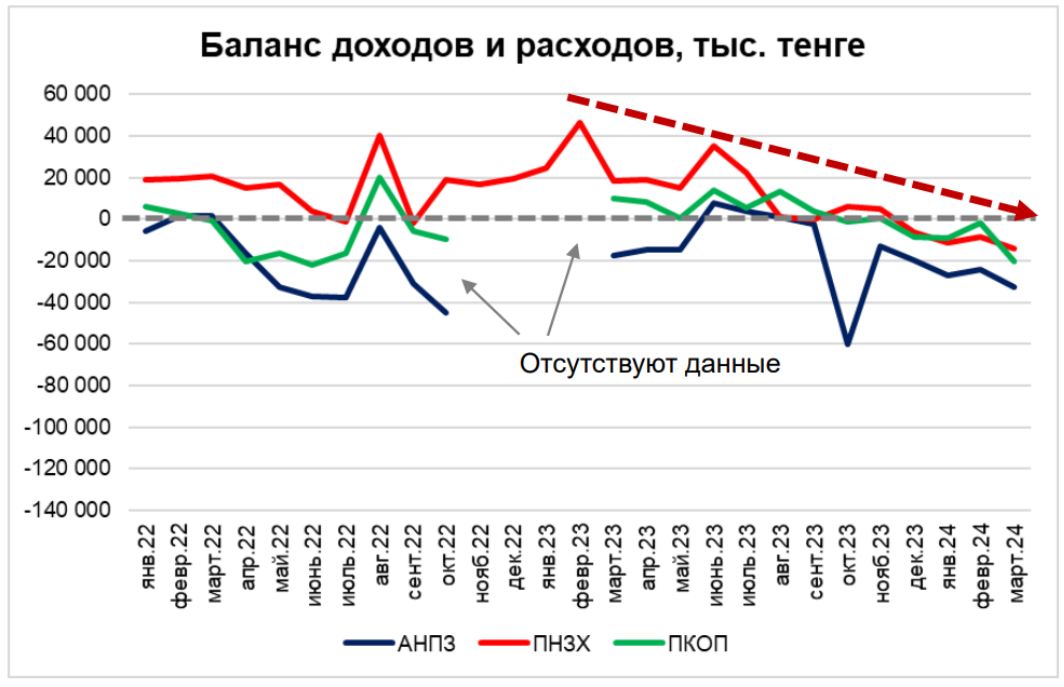

PetroMining association experts had calculated the income and expenses of oil suppliers (before tax) based on data on the output of petroleum products at refineries, average wholesale prices for the main types of petroleum products, average prices for oil on the domestic market, refining costs and excise tax rates for the period from January 2022 through March 2024.

As a result of a thorough analysis of the data, there are several reasons for the decrease in the balance of income and expenses for April 2023-March 2024, which directly affects the decrease in profits:

⦁ Fluctuations and a decrease in the yield of light petroleum products at refineries, in particular, AI-95 and DF, are recorded. As a result, this directly affects the profitability of the main types of petroleum products, and thus, the entire “basket” of petroleum products.

⦁ There is an increase in oil prices on the domestic market (Pavlodar Petrochemical Plant, PKOP); however, at the Atyrau Refinery there is a decrease in prices associated with an increase in refining/processing costs, due to the desire to maintain the profitability of refining at the Atyrau Refinery.

⦁ There are fluctuations and decreases in wholesale prices for petroleum products, which is also affected by seasonality.

As a result of a thorough analysis of the data, there are several reasons for the decrease in the balance of income and expenses for April 2023-March 2024, which directly affects the decrease in profits:

⦁ Fluctuations and a decrease in the yield of light petroleum products at refineries, in particular, AI-95 and DF, are recorded. As a result, this directly affects the profitability of the main types of petroleum products, and thus, the entire “basket” of petroleum products.

⦁ There is an increase in oil prices on the domestic market (Pavlodar Petrochemical Plant, PKOP); however, at the Atyrau Refinery there is a decrease in prices associated with an increase in refining/processing costs, due to the desire to maintain the profitability of refining at the Atyrau Refinery.

⦁ There are fluctuations and decreases in wholesale prices for petroleum products, which is also affected by seasonality.

“Calculations for gas stations were carried out based on average retail prices for petroleum products (prices on the “stack”). Based on the results of the analysis, we can see that the increase in gas station profits since April 2023 was due to an increase in the maximum retail prices for AI-92 and diesel fuel after the approval of Order No. 140 of the Minister of Energy of the Republic of Kazakhstan dated April 12, 2023,” explained Yaromir Rabay, Executive Director of the PetroMining Association.

In turn, the increase in maximum wholesale prices (Order of the Minister of Energy of the Republic of Kazakhstan dated April 12, 2023 No. 139) did not create a similar effect on the profits of oil suppliers.

To assess the impact of the maximum prices established in April 2023 (orders of the Minister of Energy of the Republic of Kazakhstan dated April 12, 2023 No. 139 and 140), calculations for gas stations for May 2023 were taken separately for the retail market in comparison with the same period in 2022.

To assess the impact of the maximum prices established in April 2023 (orders of the Minister of Energy of the Republic of Kazakhstan dated April 12, 2023 No. 139 and 140), calculations for gas stations for May 2023 were taken separately for the retail market in comparison with the same period in 2022.

At the same time, it is necessary to emphasize that there is a positive dynamics in profitability at gas stations, along with a decrease in profitability among oil suppliers, which means the presence of a disparity in profitability that has developed as a result of the establishment of ceiling prices, and a shift in the money supply from the wholesale market towards the retail market.

“The rules establish the calculation between retail and wholesale prices as the difference when converted to tons for AI-92 gasoline - 21%, for diesel fuel - 19%. This difference was calculated based on the economic conditions of the petroleum products market in 2014,” said the executive director of the PetroMining Association.

In this event, fair market conditions are required, and the optimal solution is to abolish the wholesale ceiling prices for petroleum products to eliminate the disparity between the wholesale and retail markets.

It is especially worth noting that within the framework of the Decree of the Head of State "On Economic Liberalization Measures", government agencies are already holding discussions on the abolition of ceiling prices, — PetroMining comments.

Oil-producing organizations expect a corresponding fair decision within the framework of the Decree on the liberalization of the economy.